does california have real estate taxes

However the state currently owes. Some people are unaware that the state of California has a real estate tax and property tax.

San Diego County Ca Property Tax Rates In 2022 2023 By Scott Taylor Medium

California taxes non-residents on CA-source income.

. Tax amount varies by county. The best way to avoid capital gains tax on the sale of your California residential real estate is to take full advantage of the exemption. These taxes go unpaid if theyre not paid within three years.

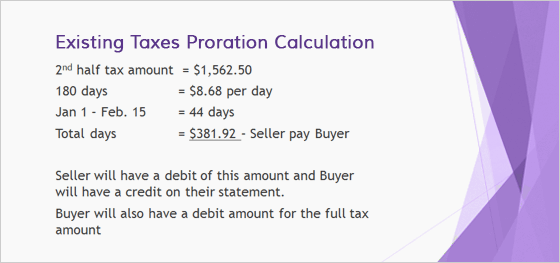

You can pro-rate any unpaid property taxes with your buyer until you finish the escrow on the house sale. Homeowners age 62 or older can postpone payment of property taxes. While property managers are often exempt from.

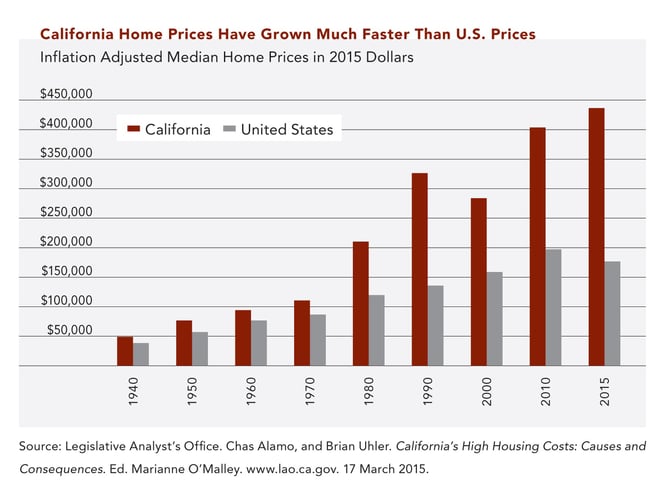

California has one of the highest average. Interestingly California has property taxes that are below the. So vacant land will likely have lower real estate taxes due to a lower assessed value.

Examples of real property. There is also no estate tax in California. The tax rate is 1 of the total home.

Although California doesnt impose its own state taxes there are some other taxes youll need to file on behalf of the deceased. California tops out at 133 per year whereas the top federal tax rate is currently 37. That means taxes are calculated by the value of the home.

A capital gain from the sale of real estate located in CA is CA-source income. Despite the many benefits of property managers in California it is crucial to remember that there are certain limitations. In addition to state income taxes any individual who owns real property is subject to state real property taxes.

The median property tax in California is 074 of a propertys assesed fair market value as property tax per year. In California a single taxpayer can save up to 250000. Assessment is based on a unit.

Property Tax California. 1 day agoThe Biden administration has proposed a new rule that could re-classify millions of gig workers as employees a move that could deal a significant blow to small businesses. California does not have an estate tax or an inheritance tax.

If an estate is worth more than 1206 million dollars for single individuals and 2412 million dollars for married couples in. That includes both the land itself and the structures on it. CA does not have a separate capital gains.

California is one of the 38 states that does not have an estate tax. Real property tax systems require owners of land and. Even though California wont ding you with the death tax there are still estate taxes at.

If you think youll need. You must have an annual income of less than 35500 and at least 40 equity in your home. Real estate withholding is a prepayment of income tax due from the selling of California land or anything on it real property.

However there are other taxes that may apply to your wealth and property after you die. Property tax in California is calculated by something called Ad Velorum.

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

California Property Taxes Viva Escrow 626 584 9999

Property Taxes Department Of Tax And Collections County Of Santa Clara

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Property Taxes And Assessments Division Auditor Controller Stanislaus County

Understanding California S Property Taxes

Property Tax Calculator Smartasset

Understanding California S Property Taxes

Property Taxes Berkeley Political Review

Property Tax Calculator Smartasset

Real Estate Refresher Helpful Tax Provisions In California And Beyond

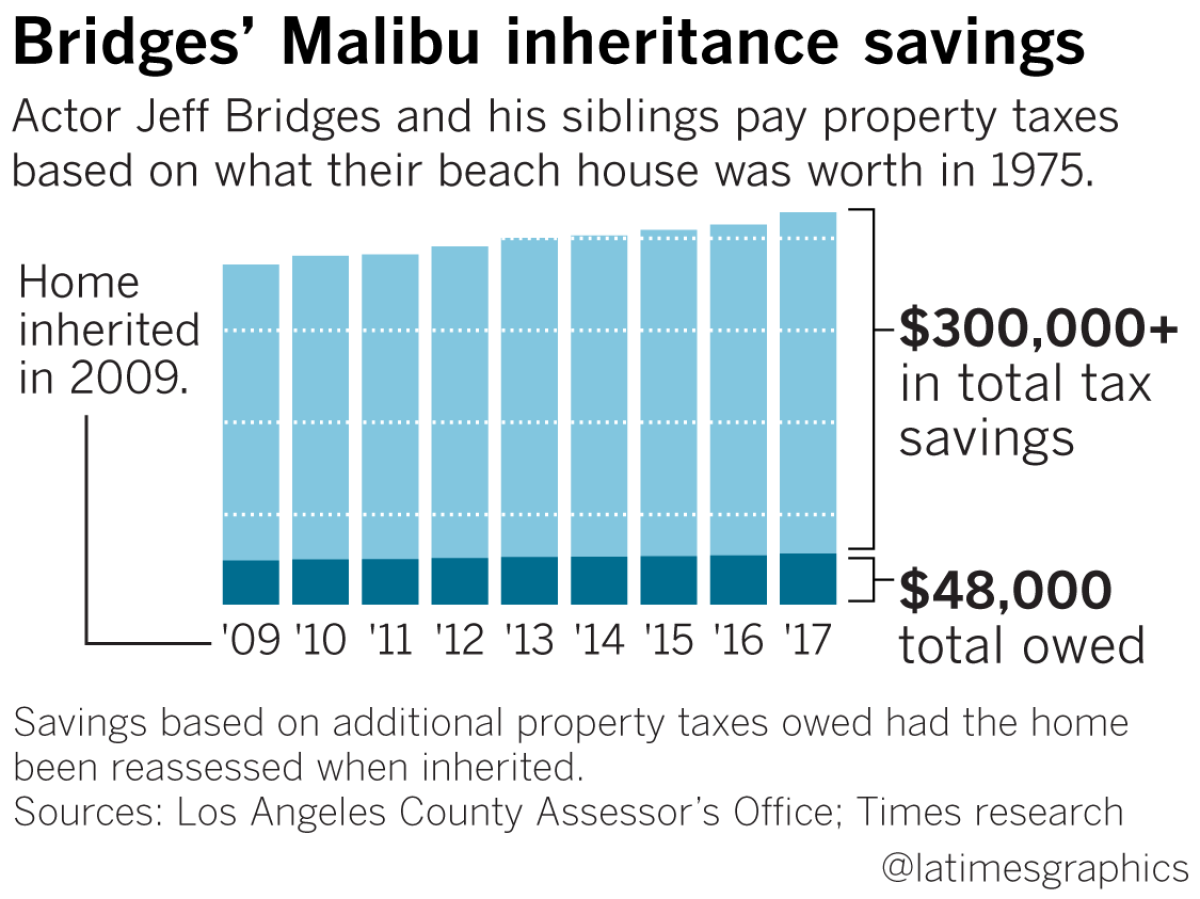

California Homeowners Get To Pass Low Property Taxes To Their Kids It S Proved Highly Profitable To An Elite Group Los Angeles Times

Property Tax Postponement Program Offered Ceres Courier

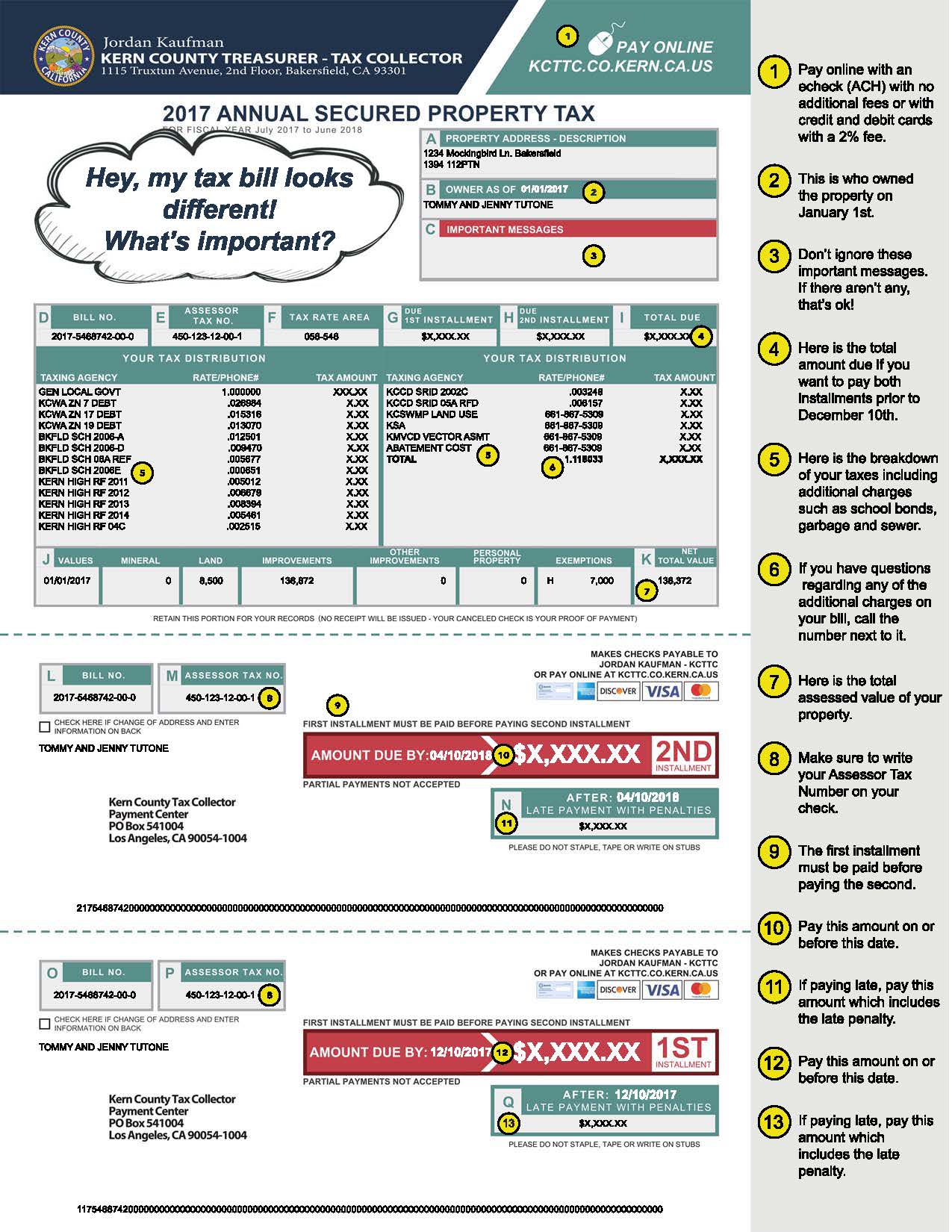

Kern County Treasurer And Tax Collector

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

California Property Taxes Explained Big Block Realty

County Of Marin Department Of Finance Where Your Property Tax Dollars Go